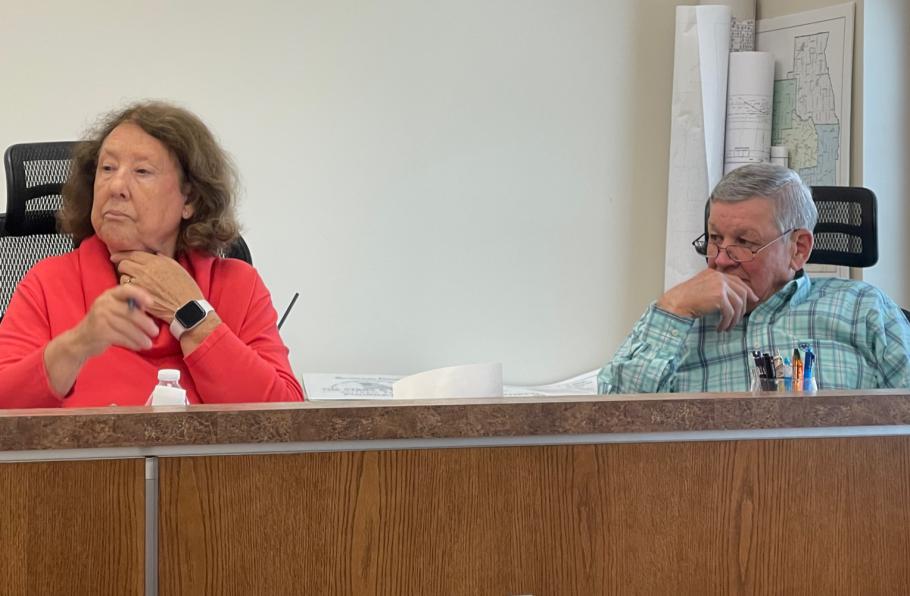

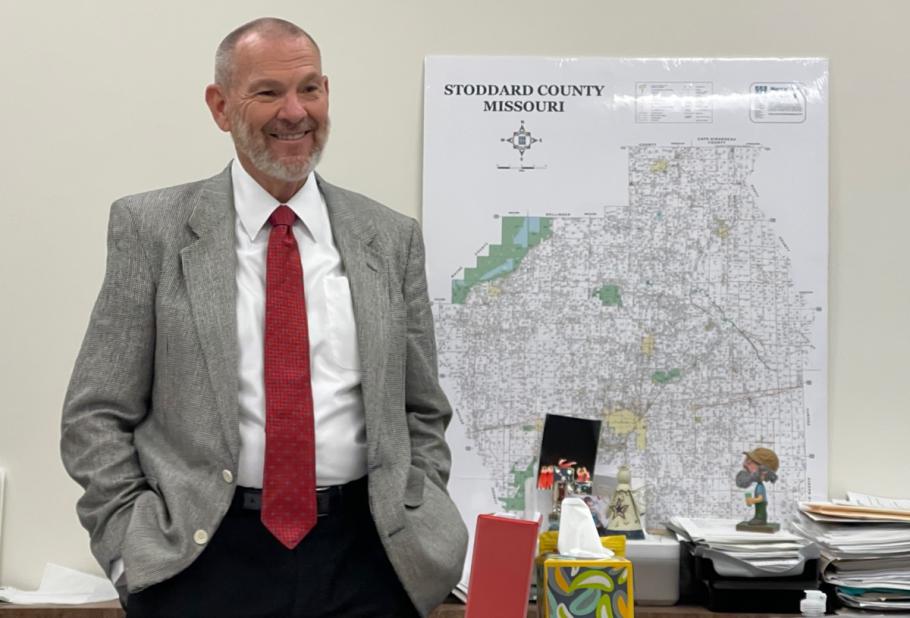

The Stoddard County Commissioner Meeting was held on Monday, May 6, 2024. Presiding Commissioner Greg Mathis opened the meeting with the Pledge of Allegiance and a prayer over Stoddard County, Missouri.

John McCarty - Employee Health Insurance Update

"The goal for your claims is typically 80%," stated McCarty. "This will keep you in the trend renewal. If you go over that then you are dipping into your claims fund. You ran 78% last year." stated McCarty.

"Here is the 1st Quarter Report. We watch these trends, but we always run a little behind on our report," commented McCarty. "January - March report you are running 123%. We are drastically over that 80%. We are spending more on claims than we want to see. We know what is causing this, but I can't talk about it in an open meeting."

"About 1/3 of the people seek out mental health/depression issues are actually doing that. Our group is drastically happier than what we are seeing in the state of Missouri, which means they are seeking out that help.."

Presiding Commissioner Greg Mathis said, "The. County is still putting more in the reserve than we are spending, so we should be in good shape."

"We have a very low deductible of $500," stated Mathis. "Do you think people are utilizing the insurance more because of that low deductible?" McCarty said, "No. You just have a few high claims in the first quarter."

"Stop loss is $35,000 for each employee with an aggregate in the policy as well. So if the employee's bills are $1 million the county will pay the $35,000 then the insurance company picks up the rest in theory."

There was more discussion about insurance, but basically the County is putting in more money than they are spending as they are self insured. They will take a look at the second quarter and see how the claims are proceeding.

Colton Gablear, Smith and Company Engineers

CR 766 Bridge Replacement for Stoddard County, MO March 2024 and CR 752 Bridge Replacement for Stoddard County, MO March 2024 update.

"We have a sub consultant working for us and getting right-away clearance, etc. Then we will be able to bid out the bridges. Might be August before we can bid out the bridges."

Audrain County, Missouri would like to sell $100,000 of Soft Match Credit for $.50 on the dollar to Stoddard County, Missouri. Cost would be $50,000.

Motion to approve the. purchase of $100,000 in Soft Match Credit from Audrain County (Mexico, MO) in the amount of $50,000. Made by Commissioner C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

BRO Funds are set aside by MoDOT and can pay up to 89%, the County has to pay the last 11%. The County can purchase Soft Match Credit from other counties.

Motion to approve the certification of plans and estimates of BRO 103 076 Stoddard County Road 752 Bridge Replacement, Railroad Impact Statement and Letter of Certification of Utility Status made by Commissioner Carol Jarrell, seconded by Commissioner C.D. Stewart. All three voted yes and motion passed.

Motion to approve the certification of plans and estimates of BRO R-103 075 Stoddard County Road Road 766 Bridge Replacement, Railroad Impact Statement and Letter of Certification of Utility Status made by Commission C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

Josh Speakman, Stoddard County Treasure/Collector - SB 190 Update

The Commissioners will set a date for a forum to discuss SB 190 Senior Property Tax Credit on Monday, June 3, 2024. Letter to the school districts as well as put in the newspaper. The Commissioners will meet with the public, but will not make a decision on that particular day. They will review all the input from the public. Teachers and railroad employees are excluded.

Here is the SB 190 as written.

SS/SB 190 - This act modifies provisions relating to the taxation of seniors.

PROPERTY TAX CREDIT

This act authorizes a county to grant a property tax credit to eligible taxpayers residing in such county, provided such county has adopted an ordinance authorizing such credit, or a petition in support of such credit is delivered to the governing body of the county and is subsequently submitted to and approved by the voters, as described in the act.

Eligible taxpayers are defined as residents who: 1) are eligible for Social Security retirement benefits; 2) are the owner of record of or have a legal or equitable interest in a homestead; and 3) are liable for the payment of real property taxes on such homestead.

The amount of the property tax credit shall be equal to the difference between the real property tax liability on the homestead in a given year minus the real property tax liability on such homestead in the year in which the taxpayer became an eligible taxpayer.

A credit granted pursuant to this act shall be applied when calculating the eligible taxpayer's property tax liability for the tax year. The amount of the credit shall be noted on the statement of tax due sent to the eligible taxpayer by the county collector.

The amount of property tax credits authorized by a county pursuant to this act shall be considered tax revenue actually received by the county for the purposes of calculating property tax levies. (Section 137.1050)

This provision is identical to a provision in HCS/SB 247 (2023) and is substantially similar to SB 715 (2022) and to a provision in SS/SCS/SB 133 (2023), as amended, SS/SB 540 (2023), as amended, and SS#2/SCS/SB 649 (2022).

RETIREMENT BENEFITS INCOME TAX DEDUCTION

Current law allows taxpayers with certain filing status and adjusted gross income below certain thresholds to deduct 100% of certain retirement and Social Security benefits from the taxpayer's Missouri adjusted gross income, with a reduced deduction as the taxpayer's adjusted gross income increases. For all tax years beginning on or after January 1, 2024, this act allows the maximum deduction to all taxpayers regardless of filing status or adjusted gross income. (Sections 143.124 and 143.125)

These provisions are identical to SB 448 (2023), SB 241 (2023), HB 662 (2023), HB 1206 (2023), SB 871 (2022), HB 2853 (2022), SB 157 (2021), SB 847 (2020), and HB 1725 (2020), and to provisions in HCS/SB 247 (2023), and are substantially similar to SB 585 (2023), HB 156 (2023), and HB 456 (2023), and to provisions in HCS/SS#3/SCS/SB 131 (2023).

Other Business:

Letter from Katelyn Lambert from the City of Essex for $50,000.00.

Motion to send the letter for the CDBG Grant for their paving project made by Commissioner C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

Motion to accept the regular meeting minutes April 29, 2024 made by Commissioner C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

Motion to approve the April Ads/Abates by Josh Speakman, County Collector/Treasurer made by Commissioner Carol Jarrell, seconded by Commissioner C.D. Stewart. All three voted yes and motion passed.

Motion to accept the Closed Session Minutes for April 29, 2024 made by Commissioner C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

Received a notice of the retirement of Mandy Clary. The Commission will need to advertise for Janitorial Services. They will also get a job description together to advertise for the position.

Stoddard County Commission go into closed session at 11:08 a.m. made by Commissioner C .D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

The Stoddard County Commission is accepting applications for JANITORIAL SERVICES at the Stoddard County Justice Center, Government Building, and original Courthouse.

A job description is available at the Stoddard County Clerk's Office.

The pay is $17.33 per hour with medical insurance, and two retirements.

Resumes may be submitted to the Stoddard County Clerk's Office, in the Government Building at Bloomfield, Missouri.

The Stoddard County Commission is an EEOC employer.

Sincerely,

Stoddard County Presiding Commissioner Greg Mathis

Saint Francis Accredited as Level 3 Epilepsy Center

The Saint Francis Healthcare System Neurosciences Institute Epilepsy Center received accreditation from the National Association of Epilepsy Centers (NAEC) as a Level 3 Epilepsy Center.

Nearly 3.5 million people across the United States are affected by active epilepsy. Epilepsy is classified as a pathology of the brain that causes a tendency to have recurrent seizures, and can come from different areas of the brain with multiple methods of treatment. Level 3 Epilepsy Centers have the professional expertise and facilities to provide the highest level medical evaluation and treatment for patients with complex epilepsy.

“This is a substantial achievement for the Saint Francis Epilepsy Center,” shared Mark E. Farrenburg, MD, neurologist and epileptologist at Saint Francis. “This accreditation really sets Saint Francis apart from other hospital systems in the area and is a testament to the high level of care our program provides.”

Level 3 is the highest level for centers who do not perform epilepsy surgery directly. As the only center between St. Louis and Memphis, the Saint Francis Epilepsy Center brings the capabilities and services usually reserved only for larger cities, including an Epilepsy Monitoring Unit, ICU continuous EEG monitoring capabilities, routine and ambulatory EEG, 3T epilepsy protocol MRI, neuropsychology services and management of neuromodulary devices such as RNS, DBS and VNS. In cases of medication resistant epilepsy, the Saint Francis Epilepsy Center performs local epilepsy surgery evaluations and develops a joint surgical plan with outside surgery centers while remaining involved throughout the process.

“Receiving accreditation from the NAEC marks a significant milestone for the Saint Francis Epilepsy Center, distinguishing Saint Francis as a leader in epilepsy care,” stated Lisa Newcomer, RRT, MBA, FACHE, Vice President of Regional Operations for Saint Francis. “This achievement reflects our dedication to expanding access to top-tier services and is a testament to our ongoing efforts to deliver exceptional care to every patient we serve.”

“I hope this recognition helps us expand our reach and provide excellent care to every single epilepsy patient in the region,” said Farrenburg.

Saint Francis Healthcare System is guided by our Mission to provide a ministry of healing, wellness, quality and love inspired by our faith in Jesus Christ. Founded by Franciscan Sisters in 1875, our priority remains the same: serve all who enter with dignity, compassion and joy. Serving nearly 713,000 people across Missouri, Illinois, Kentucky, Tennessee and Arkansas, our focus is on patients' outcomes, experience and value.

Anchored by Saint Francis Medical Center, a 306-bed tertiary hospital, and supported by nearly 3,000 employees and more than 250 providers in ten communities, the Healthcare System is a driving economic force in the region. Major services include the Cancer Institute, Emergency and Level III Trauma Center, Family BirthPlace and Level III Neonatal Intensive Care Unit, Heart Hospital, Neurosciences and Orthopedics.

Highway 60 in Butler and Stoddard counties will be reduced as contractor crews remove and replace islands at various intersections.

As work is underway, eastbound and westbound Route 60 will be reduced to one lane in each direction in the vicinity of the intersection.

This section of roadway is located between County Road 565 in Butler County and County Road 717 in Stoddard County.

Weather permitting, work will take place from Monday, May 13th through Friday, August 16th from 6 a.m. to 5 p.m. daily.

The Stoddard County Commission met on Monday, April 29, 2024 at 9:00 a.m. in the government building in Bloomfield, Missouri. Presiding Commission Greg Mathis began the meeting with the Pledge of Allegiance and a prayer over the County including the farmers who are planing this time of year.

Katelyn Lambert, Bootheel Regional Planning Commission

1. Bell City Fire Department seeking $10,000 extra to finish out their fire department building. They would like some additional lighting and concrete.

Motion to give Bell City fire Department $10,000 to finish out their fire department building from ARPA funds made by Commissioner C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

2. City of Advance - Lambert has been in communication with the mayor. He did a sole source procurement letter as there is only one company that manufactures this type of camera for the sewer. This money has already been approved by the Commission. The city is just wanted tome some funds from one project to this camera project. The cost is $22,995. Motion was already made in a previous meeting for $11,500 however this camera costs almost twice as much.

Motion to move forward for the city of Advance to purchase this camera in the amount of $22,995 from the ARPA funds which is included in their original request made by Commissioner Carol Jarrell, commissioner C.D. Stewart seconded. All three voted yes and motion passed.

3. Dudley Special Road District has the proper paperwork to be signed by the Commission for procurement for gravel and maintenance and infrastructure improvements.

Other Business:

Motion to enter into the Distribution Agreement with the Dudley Special Road District made by Commissioner Carol Jarrell, seconded by Commissioner C.D. Stewart. All three voted yes and motion passed. Presiding Commissioner Greg Mathis will sign the document.

Motion to approve payment to Smith and Co Engineers for design services for Stoddard County Road bridge #752 in the amount of $4,803.52 and will be reimbursed out of the MoDOT BRO fund made by Commissioner C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

Motion to approve payment to Smith and Co Engineers for bridge replacement #766 in the amount $10,685.05 by Commissioner Carol Jarrell, seconded by Commissioner C.D. Stewart. All three voted yes and motion passed.

Motion to allow Presiding Commissioner Greg Mathis to sign the cancellation policy release for the earthquake insurance that was voted down at the previous meeting made by Commissioner C.D. Stewart, seconded by Carol Jarrell. All three voted yes and motion passed.

Motion to accept the April 22, 2024 regular session meeting minutes made by Commissioner C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.

Motion to accept the Bid Opening Meeting minutes for the digital radio repeaters on April 22, 2024 made by Commissioner Carol Jarrell, seconded by Commissioner C.D. Stewart. All three voted yes and motion passed.

Presiding Commissioner Mathis stated, " Please note that Wednesday, May 8th the Stoddard County offices and government buildings will be closed for Harry S. Truman's birthday."

Motion to enter into closed session at 11:-05 a.m.for the purpose of cyber security made by commissioner C.D. Stewart, seconded by Commissioner Carol Jarrell. All three voted yes and motion passed.