Local News

Car Crashes - Leading Death Among Children in Missouri

April 03rd 2018 by Dee Loflin

Car crashes - a leading cause of death among children

MoDOT and the Department of Health and Senior Services know that car crashes are a leading cause of death for children ages 1-13 in the United States. Safety professionals continue to stress the importance of buckling children in an age-appropriate safety seat. It's their best defense in a traffic crash. MoDHSS Director Dr. Randall Williams reminds, "Everyone, including pregnant women and children, should use seat belts or car seats every time they ride in a motor vehicle."

In 2016, 18 children less than eight years of age were killed and 47 suffered serious injuries in motor vehicle crashes in Missouri. Twenty-nine percent of the children killed were not restrained in a car seat or seat belt. Additionally in 2016, motor vehicle crashes were responsible for eight maternal deaths (the death of a mother while pregnant or up to a year after delivery) in Missouri.

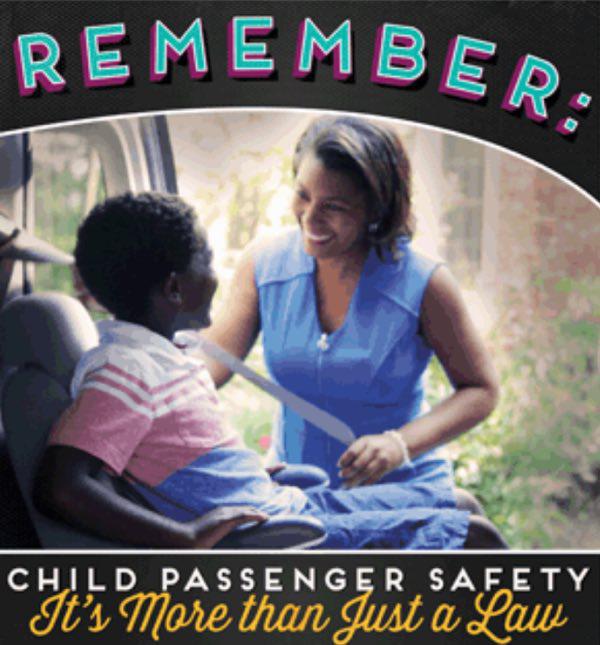

"All parents and caregivers need to understand the importance of child passenger safety seats. It's not just about following the law; child passenger seats help prevent serious injury and may even save your child's life," said MoDOT Director Patrick McKenna.

Missouri child safety seat technicians can provide education and car seat inspections. A list of car seat inspection stations and locations across the state can be found at seatcheck.org. Appointments may be necessary.

MoDOT urges everyone to get their child safety seats inspected. "When it comes to the safety of a child, there is no room for mistakes," said McKenna. "It's also all the more reason to always buckle up, everyone, every trip, every time - and put your cell phone down if you're driving - Buckle Up Phone Down."

For more information on child passenger safety or Buckle Up Phone Down, please visit www.saveMOlives.com.

Last Updated on April 03rd 2018 by Dee Loflin

https://showmetimes.com/Blogpost/va4f/Car-Crashes--Leading-Death-Among-Children-in-Missouri