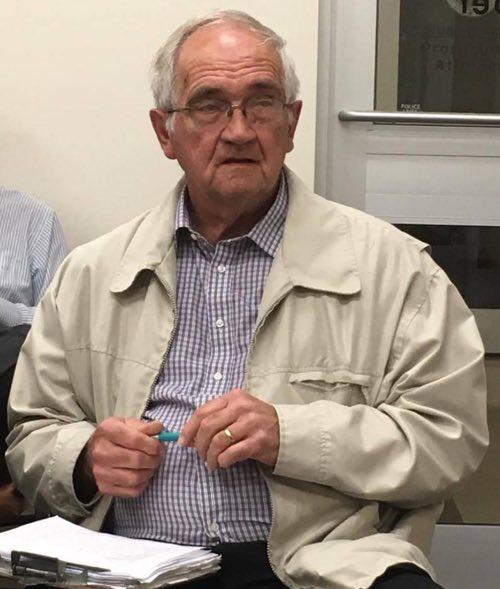

Stoddard County, Missouri - Herman Morse was elected as the new 151st State Representative for Stoddard and parts of Scott County, Missouri.

Herman Morse stated, "I am both honored and humbled to be the newly elected 151st State Representative."

His victory came with a total of 71.1% of the votes equalling 1,434 over his opponent Curtis Clark who received 26.33% of the votes or 526 total.

Voter turnout was considered to be low as expected as there were only the two items on the ballot; the 51st State Representative position and the Use Tax Proposition which also passed by a vote of 1,118 to 831.

"Thanks to everyone who voted for me in Tuesday's special election to fill the vacant seat for the 151st Representative District," commented Morse. "A fairly short election cycle and a large geographical area made it impossible to tell each of you that I would appreciate your vote. Even if I didn't meet you in person, your opinion is still important to me. I hope to meet and visit with many more of you in the next few months."

"I pledge to represent the people of Stoddard County and the western part of Scott County to the best of my ability," continued Morse.

"Thanks again for your support and I look forward to serving you!"

Stoddard County, Missouri - A Special Election will be held in Stoddard County on Tuesday, November 7, 2017 as certified by the Honorable John R. Ashcroft, Secretary of State for Missouri.

The ballot for the election shall be the following:

State Representative 151st Legislative District to fill (Unexpired Term) - Running are Curtis Clark, Herman Morse, and Rick Vandeven.

Curtis Clark is running as Democrat, Herman Morse as Republican, and Rick Vandeven as a Libertarian.

Use Tax Proposition on Stoddard County - Shall the County of Stoddard impose a local use tax on out-of-state purchases at the same rate as the total local sales tax rate, currently one percent (1%) provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action? A use tax return shall not be required to be filed by person whose purchases from out-of-state vendors do not in total exceed two thousand dollars in any calendar year. The purpose of the proposal is to eliminate the current sales tax advantage that Non-Missouri vendors have over Missouri vendors.

Approval of this proposition will result in a continuation of local revenue to provide vital services for Stoddard County.

Polls will be open at 6:00 a.m. in the morning and will close at 7:00 p.m. in the evening on Tuesday, November 7, 2017.