Have You Made Your 2016 IRA Contribution? - Sponsored by Bagby Wealth Management

Who Can Open a Traditional IRA?

You can open and make contributions to a traditional IRA if:

You (or, if you file a joint return, your spouse) received taxable compensation during the year, and

You were not age 70½ by the end of the year.

You can have a traditional IRA whether or not you are covered by any other retirement plan. However, you may not be able to deduct all of your contributions if you or your spouse is covered by an employer retirement plan.

Both spouses have compensation. If both you and your spouse have compensation and are under age 70½, each of you can open an IRA. You cannot both participate in the same IRA. If you file a joint return, only one of you needs to have compensation.

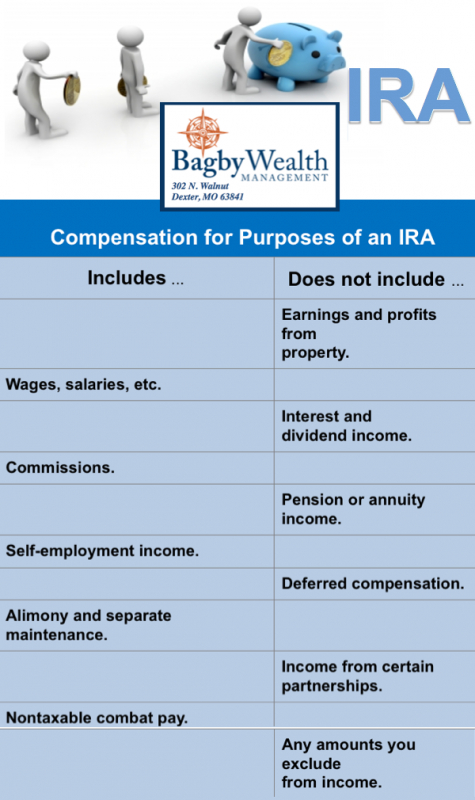

What Is Compensation?

Generally, compensation is what you earn from working. Compensation includes all of the items discussed next (even if you have more than one type).

When Can a Traditional IRA Be Opened?

You can open a traditional IRA at any time. However, the time for making contributions for any year is limited.

How Can a Traditional IRA Be Opened?

You can open different kinds of IRAs with a variety of organizations. Any IRA must meet Internal Revenue Code requirements.

Kinds of traditional IRAs.

Your traditional IRA can be an individual retirement account or annuity. It can be part of either a simplified employee pension (SEP) or an employer or employee association trust account.

Individual Retirement Account.

An individual retirement account is a trust or custodial account set up in the United States for the exclusive benefit of you or your beneficiaries. The account is created by a written document. The document must show that the account meets certain requirements.

How Much Can Be Contributed?

There are limits and other rules that affect the amount that can be contributed to a traditional IRA.

General Limit

For 2016, the most that can be contributed to your traditional IRA generally is the smaller of the following amounts:

$5,500 ($6,500 if you are age 50 or older), or

Your taxable compensation for the year.

When Can Contributions Be Made?

As soon as you open your traditional IRA, contributions can be made to it through your chosen sponsor.

Contributions must be made by due date. Contributions can be made to your traditional IRA for a year at any time during the year or by the due date for filing your return for that year, not including extensions. For most people, this means that contributions for 2016 must be made by April 15, 2017, and contributions for 2017 must be made by April 15, 2018.

Age 70½ rule. Contributions cannot be made to your traditional IRA for the year in which you reach age 70½ or for any later year.

Designating year for which contribution is made. If an amount is contributed to your traditional IRA between January 1 and April 15, you should tell the sponsor which year (the current year or the previous year) the contribution is for. If you do not tell the sponsor which year it is for, the sponsor can assume, and report to the IRS, that the contribution is for the current year (the year the sponsor received it).

Filing before a contribution is made. You can file your return claiming a traditional IRA contribution before the contribution is actually made. Generally, the contribution must be made by the due date of your return, not including extensions.

Contributions not required. You do not have to contribute to your traditional IRA for every tax year, even if you can.

How Much Can You Deduct?

However, if you or your spouse was covered by an employer retirement plan, you may not be able to deduct this amount.