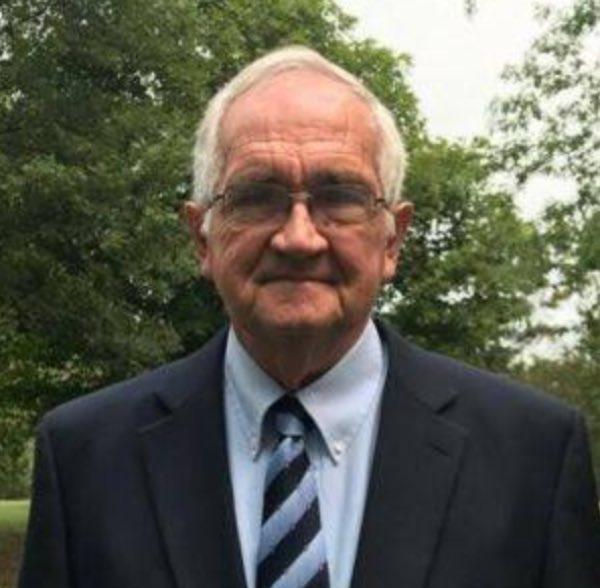

Jefferson City, Missouri - Herman Morse of Dexter has settled into his new role as the District 151 State Representative after being sworn into office on January 10, 2018.

He will serve on three separate committees while representing District 151 in the Missouri State House of Representatives.

Morse will serve on the Agriculture Policy, Corrections, and PUblic Institutions and Consent and House Procedures committees.

He will serve with 12 other representatives on the Agriculture Policy Committee. There are ten total members on the Policy Committee and there are 13 on the Consent and House Procedures Committee.

You can contact Herman Morse at (573) 751-1494 or (573) 820-7502.

Dexter, Missouri - The Stoddard County Democrat Club met on Monday, January 22, 2018 at 11 N. Walnut Street in Dexter. Harold Gibson, opened the meeting with a prayer. Richard Wilson lead in the Pledge of Allegiance.

Kay Wooley presented the secretary's report and Ruth Gibson informed members of the upcoming meetings and speakers including brenda Schnader of Poplar Bluff, Tom Bischof speaking for V.A.N. Voter Access Network, and Mike Moroni.

Peter Beaudry will serve as the new treasurer, replacing Ruth Gibson, who will still have a presence at the meetings, but will no long serve in that capacity.

Members learned that their president, Peggy Barks, is doing well as she battles cancer.

Article submitted by Theatta Cokley.

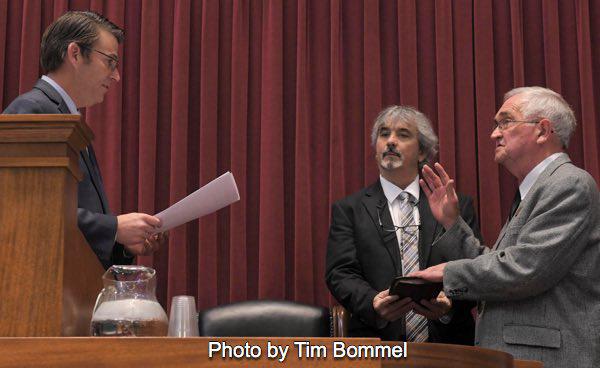

Jefferson City, Missouri - Dexter resident Herman Morse is shown inside the state capital in Jefferson City on Wednesday, January 10, 2018 as he takes the oak of office to serve as Missouri's District 151 State Representative.

Morse won the November 2017 special election after Representative Tila Hubrecht resigned from the post at mid-term.

Morse will complete the term in 2018 and must run in the November 2018 election to retain his seat for two more years.

Pictured are Missouri House Speaker Todd Richardson, (R) Poplar Bluff administers the oath of office to Rep. Elect Herman Morse (R) Dexter, as Rep. Steve Cookson, (R) Poplar Bluff watches on.

Photo credit to Tim Bommel, Photojournalist, Missouri State Capitol, Rm. B-32, Jefferson City, MO

Congressman Smith Capitol Report

The Early Returns

January 12, 2018

On December 22, the Tax Cuts and Jobs Act was signed into law by President Trump. What has happened in the succeeding three weeks is just the beginning of a long and empowering process to reward the American worker for years of sacrifice, dedication and hardship. In these three weeks, over two million U.S. workers have seen bonuses, pay raises, and benefit increases totaling more than one billion dollars…that’s right more than $1,000,000,000.

Whether you are in Missouri and work at an AT&T store, for Boeing or Southwest Airlines, you have already seen the impact of the Tax Cuts and Jobs Act through the bonuses issued from your employer as a result of the new law. Right here in southeast and south central Missouri, we are no exception. We have seen companies like Express Employment Professionals with employees in Rolla hand out $2,000 bonuses to more than 200 non-executive level employees. In addition, Commerce Bank with operations in Cape Girardeau has said that 3,450 employees will receive bonuses and U.S. Bancorp with a presence in Willow Springs has said that 60,000 employees will receive bonuses and wage hikes – all have cited passage of the Tax Cuts and Jobs Act as the driving reason.

Beyond bonuses, companies like Walmart with a distribution center in St. James and stores in places like Perryville, Kennett, Potosi and elsewhere have said that as a result of the Tax Cuts and Jobs Act, they will increase hourly wages starting in February and hand out bonuses to all hourly workers. The new law has also now put them in a position to be able to offer up to 10 weeks of paid maternity leave to employees. Elsewhere, many utility providers are passing the new tax savings on to customers in the form of lower rates, helping millions of families who struggle every month to keep the lights on while also feeding a hungry family.

This is what this tax bill was all about, allowing you to keep and save more of what you earn and what is already yours. Like I said, this is just the beginning. Millions more Americans will notice something different in their February paychecks…they will be higher. Even without bonuses, pay raises, or benefit changes, the new lower tax rates in effect starting this year will result in a smaller amount being deducted from your paycheck than ever before. That’s right, what yours is yours, not Washington’s – you should be free to do with that money what you see fit - investing in your farm, buying new clothes for your children, going out to a family dinner, or simply saving for your family’s future.

As the calendar moves further into 2018, I look forward to continuing to stand next to our President to deliver the kind of change that so many of you have called for. Reducing the taxation burden and making sure you are more empowered and liberated than the Washington machine was a good beginning, but so much more work lies ahead. Investments in our nation’s crumbling infrastructure and also making real and substantive changes to bring work requirements back into government assistance programs are major challenges that I am ready for, but which still lurk ahead. Providing relief from the crushes of a tax code too big, too cumbersome and which was taking too much was something I have long fought for and believe in, I look forward to continuing to fight for you with that same determination and vigor in these new challenges we now face.