Dear Friend,

Tax day has come and gone for most, but some taxpayers are still trying to get their returns straight. This year, there has been an astronomical uptick in identity theft used for fraudulent tax returns. When some law-abiding citizens filed their tax returns, they discovered a thief had already used their social security number to file a return. That leaves the taxpayer with months of frustrating calls and letters to the IRS to get it straight. This week I took action to prevent this abuse on hardworking taxpayers.

The Government Accountability Office found that fraudulent tax returns cost more than $5 billion each year. The Southeast Missourian reported, “The number of identity theft/tax return fraud incidents rose nearly 85 percent, to 2.9 million, from 2010 to 2013, according to the most recent IRS statistics report available,” and folks in our area have been feeling that rise. A spokesman for the Cape Girardeau Police Department said, “We've never seen reports like this before.”

This week I questioned IRS Commissioner John Koskinen about tax fraud during a Ways and Means subcommittee hearing and shared just how hard our area has been hit by identity theft. I pushed him to provide increased scrutiny to online filings since they are more likely to be fraudulent. Right now online applications are not held to the same standards as those submitted on paper. Online filings and paper filings should have the same level of scrutiny. The IRS must also be more proactive in preventing this identity theft instead of waiting until hardworking Americans have their information stolen.

Thieves are constantly creating new ways to obtain a combination of personal information such as birth dates, social security numbers, and addresses, but there are a few ways you can avoid being victimized. The IRS recommends that you do not carry your social security card with you and only give a business your social security number when they require it. The IRS also recommends that you check your credit report every 12 months for any irregularities. Updating your computer’s software and security programs can help keep your information from falling into the hands of criminals. If you feel like you are at risk for identity theft due to having personal information stolen, please contact the IRS so they can take action to secure your account.

Both the IRS and taxpayers need to be vigilant and proactive in keeping accounts safe as identity theft continues to rise. My commitment is to continue providing oversight to the IRS and fighting to protect taxpayers, because those who work hard and play by the rules deserve our support.

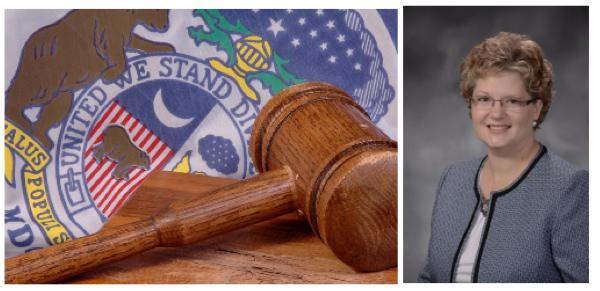

151st District, Missouri - Capitol News

Hello to you!! It has been an incredibly busy week with less than a month to go of session. I was at the Capitol late each night this week, I don't think I left the building before 10pm any night! This week we finished the final debate of the budget with it now being prepared to be sent to the Governor. I am glad to have this portion of our legislative work this far before May arrives. I was very pleased with some of our accomplishments on the budget. I will list just a few of these below:

Public Debt---ALL debt obligations will be met for FY 2016

Elementary & Secondary Education

• $5.78 billion for K-12 Education — record funding for our public schools

• Increased funding for the Foundation Formula by $84 million — $34 million more than the Governor’s recommendation

• Continued funding Parents as Teachers ($2.4m), Virtual Education for Medically Frail Students ($200k), Teach for America($1m) ...just to name a few of these programs with more of these being expanded to rural areas

• Defunded Common Core — that money must be used to create a MO-based testing system Higher Education

• $1.26 billion for higher education • Increased funding for 2 and 4 year public colleges and universities by $30 million

Dept of Revenue & MoDOT

• $200k for the implementation of a new registration and licensing system

• Cut travel expenses for executive agencies

• Funding for an I-70 tolling study

• $3m for capital improvements at Missouri ports

• $500k for transit providers Office of Administration & State Employees

• Cut travel expenses for executive agencies

• Eliminated funding across the budget for the Governor’s “Office of Community Engagement”

• $1.5m more than the Governor’s recommendations for IT security upgrades

I didn't vote to support HB 11 as I had some concerns with the expansion of Managed Care. I am relieved that before this can be fully implemented there will be a complete study done with many meetings during the interim, which I will be attending, to ensure that this will be a positive for Missouri.

Committee work has been very busy. I expect committee work to continue to be busy with this schedule becoming even busier as we count down to the end of session. I have worked closely with several other committee members on various bills to make changes or study to ensure that these bills will have a positive impact on Missouri.

The bill that I authored, House Bill 1262, regarding the Schools for the Severely Disabled, will possibly make the House floor this week or next week. I am very excited about this. With is being so late in session, I am also working to see if there is a possibility to add this bill as an amendment on another closely related bill to move it closer to the Governor's desk.

I will close for now but please free to call me or my office any time that I can be of service to you!!

Until Next Week,

Tila

8th Congressional District, Missouri - This week, I voted to repeal the death tax and help put the American Dream back within reach for family farmers across southeast and southern Missouri. Since I was first elected to Congress, I have worked to get a vote on repealing the death tax for family farmers, including cosponsoring this important piece of legislation. Across our area, farmers worry that the death tax will keep them from passing the family farm down to their children. A full repeal of the death tax would alleviate this worry and encourage the kind of entrepreneurship America was built on.

When the owner of a family farm dies, there is a tax on the value of the land, machinery and assets the owner is passing to their children once the value reaches a certain threshold. Farming assets can add up quickly between combines, tractors, machinery and farm land, but these family farmers are not rich. Nearly 85 percent of the value of a modern family farm is in non-liquid assets. Before they know it, those assets can be enough to trigger the estate tax, or as we have come to call it, the death tax.

When a family is grieving the loss of a loved one, they are hit with the IRS’s death tax which requires a cash payment. They can be forced to sell land or machinery and stripped of their livelihood. If the families choose to take out a loan to pay the taxes, it can take years to pay back the money and can hold them back from hiring employees and expanding their farm.

Family farms have played by the rules and already paid taxes throughout the years just to be taxed again after a death in the family. These folks pay real estate tax, federal and state income tax, and payroll taxes for their employees. It is unfair to take almost 50 percent of the business they have built just because they want to keep the farm in the family.

It has been 10 years since the House last voted to repeal the death tax. I am proud to continue to fight for farmers in southeast and southern Missouri and bring attention to this unfair tax. As a fourth-generation owner of my family’s farm, I know firsthand that repealing the death tax is one step toward ensuring these hardworking folks can continue to strive for the American Dream.

Mobile Offices are opportunities for Missourians to discuss their questions or concerns with the federal government one-on-one with members of Senator Blunt’s staff.

Senator Blunt’s Columbia office also extends one-on-one service to all Missourians who have an issue with a federal agency or need additional assistance.

To reach the Senator’s Office of Constituent Services, please call at (573) 442-8151 or send a letter to 1001 Cherry Street, Suite 104, Columbia, Missouri 65201.

What: Senator Blunt's Staff Hosts Mobile Office

When: Thursday, April 23, 2015 from 1:30pm to 2:30pm

Where: Stoddard County Courthouse

401 S. Prairie Street

Bloomfield, MO

A Taxing Experience

Last year, former Secretary of State Donald Rumsfeld sent an open letter to the IRS commenting on just how frustrating it has become to navigate America’s tax code maze. He wrote, “The tax code is so complex and the forms are so complicated that I cannot have any confidence that I know what is being requested and therefore I cannot and do not know, and I suspect a great many Americans cannot know, whether or not their tax returns are accurate.” And he is right.

We need to make the tax code fairer and simpler. In addition to families around the country, 98 percent of farms are taxed under the individual income tax code. The complicated tax code means uncertainty for job creators and folks just trying to work hard and play by the rules. Even President Obama has called for a simpler, fairer tax code, and I hope he’s ready and willing to work with Congress to make that happen.

America cannot tax our way to job creation or providing families economic stability and peace of mind. According to The Tax Foundation, an independent tax policy research organization, “Americans will collectively spend more on taxes in 2015 than they will on food, clothing, and housing combined.” In 2015, Americans will have to work 114 days just to pay their tax bill. In 1930, Americans had to work less than half of that – just 43 days – to meet their tax obligations. That is money that taxpayers could use to add new jobs, expand plants, and grow small businesses.

As Benjamin Franklin said, “Nothing is certain in life but death and taxes.” We don’t mind paying our fair share, but it is time that Washington got serious about tax reform. Americans deserve to keep more of their hard-earned money in their pockets.